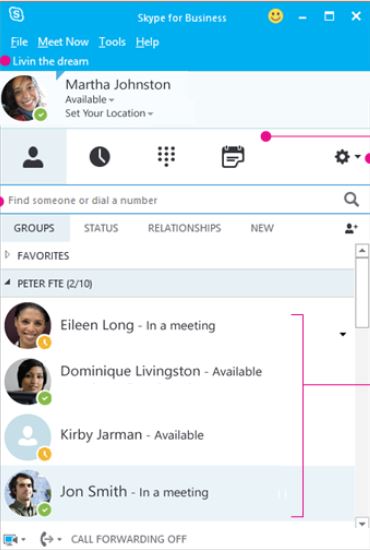

However, as good as this might be to end-users, it would probably serve only to kill Windows Phone stone dead for carriers.Īs much as telephony integration into Microsoft's communications products and VoIP integration into its telephony product makes sense, it's hard to make sense of the deal. Integrated multinational VoIP support would potentially be enormously disruptive to the cellphone market. Perhaps more adventurous, integrating Skype-like functionality into Windows Phone would be something of a game-changer. The company also plans to integrate Kinect into Lync to create more natural virtual presences. The underlying technology of both platforms is common, allowing interoperability between Live Messenger and Lync. Microsoft has an equivalent corporate-oriented system, Lync 2010 (formerly Office Communication Server) that allows companies to create private networks that combine the communications capabilities of Live Messenger with corporate manageability. It currently boasts around 330 million active users each month, typically with around 40 million online at any one moment. Windows Live Messenger offers free instant messaging, and voice- and video-chat. Microsoft's own software already has considerable overlap with Skype. A $7 billion Skype acquisition would show that perhaps Redmond believes it has resolved such problems. Microsoft has in the last couple of years shied away from similar large acquisitions, sticking to buying smaller, easier-to-manage organizations, leading some to argue that this was a direct result of the digestive difficulties faced with the large purchases. The aQuantive purchase too had mixed outcomes, with Redmond unable to find a role for the Razorfish division before eventually selling it off in 2009 Microsoft continues to be unable to make a profit from online advertising. Danger, the exciting mobile technology company that produced the Hiptop, better known as the T-Mobile Sidekick line, was purchased for an estimated $500 million in 2008 the result of that purchase was the disastrous KIN phone and a complete failure to integrate the bought-in talent.

That alone makes it surprising the company's track record with large purchases is decidedly mixed. The purchase was Microsoft's biggest ever, surpassing even the $6 billion acquisition of advertising firm aQuantive in 2007. EBay then sold the majority of its stake in 2009 to a private investment group for $1.2 billion less than it paid. This is the second time Skype has been bought out after being started in 2003, it was purchased by eBay in 2005 for $3.1 billion. However, overall it made a small loss of $7 million, and had long-term debt of $686 million.

Last year, Skype had revenue of $860 million on which it posted an operating profit of $264 million. Just days after reports that Google and Facebook were interested in partnering with, and possibly buying VoIP company Skype, Microsoft announced that it was buying the company for $8.56 billion in cash.

0 kommentar(er)

0 kommentar(er)